Getting the right auto insurance can feel like a chore, but it’s a necessary one. Whether you’re cruising down the streets of Florida or navigating the highways of Texas, having adequate coverage is crucial. But where do you even start? Well, let’s talk about auto insurance quotes. It’s the first step to finding the optimal policy for your needs and budget. And hey, it doesn’t have to be as complicated as it sounds. Let’s dive in!

Navigating the World of Auto Insurance Quotes in Florida : Finding the optimal Deal

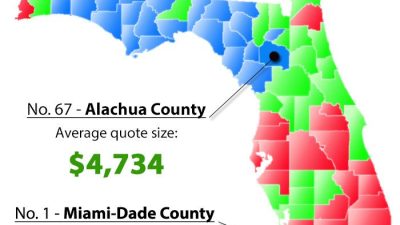

Looking for an auto insurance quote in Florida ? You’re not alone. With so many options available, it can feel like navigating a maze. But don’t worry, it’s totally doable! The key is to understand what you need and then shop around. Whether you’re after basic coverage or something more thorough, getting multiple auto insurance quotes Florida is the first step. And hey, while you’re at it, consider looking into auto and home insurance bundles for potential savings. It’s like getting a two-for-one deal, but for your peace of mind!

Beyond Florida : Exploring Car Insurance Quotes Across the US

Okay, so maybe you’re not in the Sunshine State. No problem! The need for good car insurance is universal. If you’re in Massachusetts, you’ll want to check out car insurance quotes Massachusetts. Or perhaps you’re in the mountains of Colorado, then car insurance quotes Colorado is what you need. And let’s not forget about the Lone Star State, where car insurance Texas is a must. Each state has its own regulations and requirements, so it’s crucial to get quotes specific to your location. And if you’re thinking about moving, remember to factor in the cost of auto insurance in your new area. It’s all part of being a responsible driver!

Related Post : Auto Insurance Florida

The Power of Bundling : Home and Auto Insurance Savings

Have you ever thought about bundling your home and auto insurance ? It’s a smart move that can save you some serious cash. Many insurance companies offer discounts when you combine your policies. So, if you’re looking for home and auto insurance , it’s definitely worth exploring. This is especially true if you’re already happy with your current offerr. Bundling can simplify your life and your bills, plus it often leads to lower premiums. It’s a win-win situation!

Decoding Auto Insurance Quotes : What to Look For

So, you’ve got a bunch of auto insurance quotes in front of you. Now what? It’s time to dig into the details. Don’t just look at the price tag. Pay attention to the coverage limits, deductibles, and any additional benefits. Are you getting the right amount of liability coverage? What about collision and thorough? Understanding these terms is key to making an informed decision. And remember, a cheap auto insurance pa might not always be the optimal option if it doesn’t offer adequate protection. It’s about finding the right balance between cost and coverage.

Finding the optimal Auto Insurance : Tips and Tricks

Ready to find the optimal auto insurance for you? Here are a few tips. First, shop around! Don’t settle for the first quote you get. Compare multiple auto insurance quotation from varied companies. Second, consider your driving record. A clean record usually means lower premiums. Third, think about your vehicle. The type of car you drive can affect your insurance rates. And finally, don’t be afraid to ask querys. If something is unclear, reach out to the insurance company for clarification. Whether you’re looking for the optimal auto insurance in Texas or the optimal car insurance in Texas , doing your homework is essential. And hey, if you’re in Florida, don’t forget to check out Florida vehicle insurance options too!

Finding the right auto insurance doesn’t have to be a headache. Whether you’re in Florida, Texas, or anywhere else, taking the time to compare quotes and understand your options can lead to significant savings and peace of mind. Remember, the optimal policy is one that fits your needs and budget, so shop around and don’t be afraid to ask querys. And hey, bundling your home and auto insurance might just be the ticket to even more savings!