In today’s fast-paced business world, managing payroll efficiently is crucial for the achievement of any small business. The right payroll billing software can make all the difference, streamlining processes, ensuring accuracy, and saving valuable time. But with so many options available, how do you select the optimal solution for your needs? This article will explore the key attributes, benefits, and considerations when selecting payroll software for your small business, covering everything from basic payroll functions to more advanced attributes like integration with other business systems. Whether you’re looking for the optimal accounting software for smes or a thorough payroll solution, this guide will help you make an informed decision.

The Importance of Payroll Billing Software for Small Businesses. For small businesses, managing payroll can be a complex and time-consuming task. From calculating wages and taxes to ensuring compliance with ever-changing regulations, it’s a process that demands accuracy and attention to detail. This is where payroll billing software comes in. It automates many of these tasks, reducing the risk of errors and complimentarying up valuable time for business owners and their teams. The right software can handle everything from calculating paychecks to managing deductions and generating reports, making payroll a much smoother and more efficient process. This is especially true for businesses that also need to manage other facets of their operations, such as those that might use hvac business software or electrician service software. Integrating payroll with other business functions can streamline workflows and improve overall efficiency.

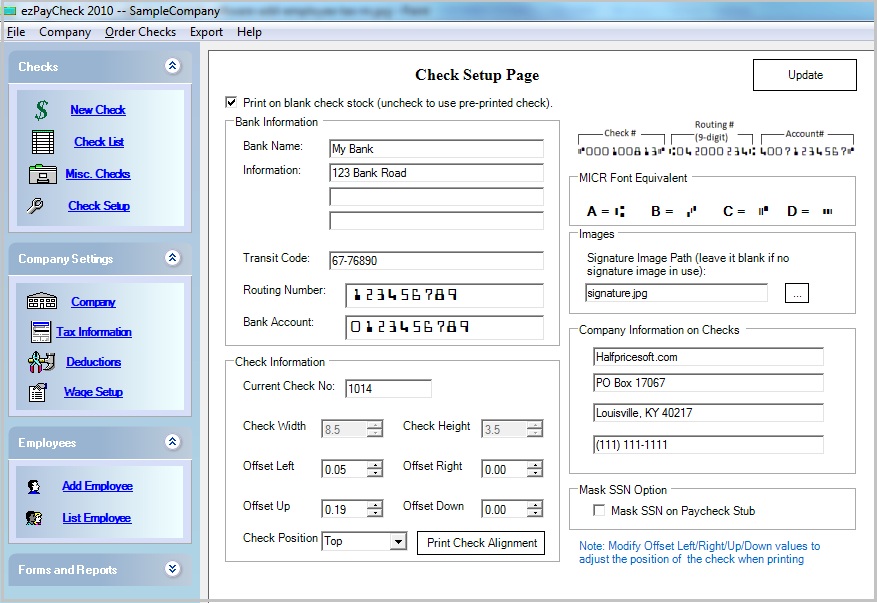

Key attributes to Look for in Payroll Software. When choosing payroll software, there are several key attributes to consider. First and foremost, the software should be user-friendly and easy to navigate. It should also be able to handle the specific needs of your business, whether you’re a small team or a growing company. Look for attributes such as automatic tax calculations, direct deposit options, and the ability to generate detailed reports. Integration with other business software, such as online accounting software or contract management software, is also crucial. This allows for seamless data transfer and reduces the need for manual data entry. For businesses that need to manage field operations, integration with fleet tracking software can also be beneficial. Additionally, consider whether you need attributes like expense management software for small business or corporate travel software, which can further streamline your financial processes.

Cloud-Based vs. On-Premise Payroll Solutions. One of the first decisions you’ll need to make is whether to opt for a cloud-based or on-premise payroll solution. Cloud-based solutions, also known as cloud accounting software or cloud bookkeeping software, offer several benefits, including accessibility from anywhere with an internet connection, automatic updates, and often lower upfront costs. They are also generally more scalable, making them a good choice for growing businesses. On-premise solutions, on the other hand, require you to install and maintain the software on your own servers. While they may offer more control over your data, they can also be more expensive and require more technical expertise to manage. For most small businesses, cloud-based solutions are the preferred choice due to their convenience and cost-efficacy. This is especially true for businesses that are already using other cloud-based tools, such as hvac management software or contact center software.

Payroll Software for Specific Industries. While many payroll software solutions are designed to be versatile, some industries have unique needs that require specialized software. For example, businesses in the construction industry may need construction accounting software that can handle job costing and project-based payroll. Similarly, HVAC businesses may benefit from hvac software that integrates payroll with other facets of their operations, such as scheduling and dispatch. It’s crucial to select software that is tailored to your specific industry to ensure that it meets all of your needs. This can also help you avoid the need for multiple software solutions and streamline your workflows. For example, a business using contract mgmt software might want a payroll solution that integrates seamlessly with their contract management system.

Related Post : online accounting software small business

Choosing the Right Payroll Software for Your Small Business. selecting the right payroll software is a crucial decision that can have a significant impact on your business’s efficiency and compliance. Start by assessing your specific needs and requirements. Consider the size of your business, the number of employees, and the complexity of your payroll processes. Look for software that offers the attributes you need, is easy to use, and fits within your budget. Don’t be afraid to try out complimentary trials or demos before making a decision. Read reviews and compare varied options to find the optimal fit for your business. Remember, the optimal payroll software for small business is the one that meets your unique needs and helps you streamline your operations. This might include software for payroll for small business or small business software with payroll, depending on your specific requirements.

In conclusion, selecting the right payroll billing software is a pivotal decision for any small business. It’s about more than just paying employees; it’s about streamlining operations, ensuring compliance, and complimentarying up valuable time to focus on growth. Whether you’re in the HVAC industry, construction, or any other sector, the right software can be a game-changer. Explore your options, consider your specific needs, and invest in a solution that will support your business’s achievement for years to come. Remember, the optimal payroll software for small business is the one that optimal fits your unique requirements and helps you achieve your business objectives.