In today’s fast-paced business world , cash flow is king. For many small and medium-sized enterprises (SMEs) , waiting for customer payments can create significant financial strain. This is where invoice finance comes into play , offering a solution to unlock the cash tied up in unpaid access-based invoices. But with so many offerrs out there , how do you select the right one ? This article will delve into the world of invoice finance , focusing on offerrs like Beyond Finance and exploring what you need to know to make an informed decision.

Understanding Invoice Finance : A Quick Overview

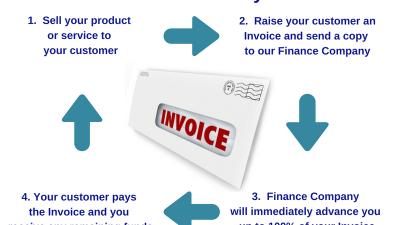

Before we dive into specific offerrs , let’s quickly recap what invoice finance is all about. In essence , it’s a way for businesses to unlock the cash tied up in their unpaid access-based invoices. Instead of waiting 30 , 60 , or even 90 days for customers to pay , you can get a significant portion of that money upfront. This can be a lifesaver for businesses that need to maintain cash flow , invest in growth , or cover operational expenses. Now , let’s explore some of the key players in this space , including the much-talked-about Beyond Finance.

Beyond Finance : A Closer Look

Beyond Finance has been making waves in the invoice finance arena , and it’s no surprise that many business owners are asking querys like , “Is Beyond Finance legit ?” or “Does Beyond Finance really work ?” The answer , like with most financial services , is nuanced. Beyond Finance reviews often highlight the ease of their application process and the speed at which funds are released. However , it’s crucial to dig deeper than just the surface. Some users have shared their experiences with Beyond Finance reviews complaints , which often revolve around fees and cancellation policies. It’s essential to thoroughly understand the Beyond Finance cancellation policy reviews before committing. If you’re considering a career with them , you might be interested in Beyond Finance jobs , including Beyond Finance work from home and Beyond Finance remote jobs. Beyond Finance employee reviews can offer insights into the company culture and work environment. Also , checking Beyond Finance google reviews can offer a broader perspective from various users.

Related Post : beyond finance job reviews

Beyond Finance : What the Reviews Say

When studying any financial service , it’s vital to look at a variety of sources. Beyond Finance job reviews can give you an idea of what it’s like to work there , while Beyond Finance review can help you understand the customer experience. Some users have praised their customer service , while others have expressed concerns. It’s also worth noting that some people might be searching for “echo park financing reviews” or “enterprise finance guarantee” , which are varied entities altogether. It’s crucial to ensure you’re looking at the correct company when reading reviews. For example , if you’re looking for information on “huntington financing” or “verizon phone financing” , you’ll find that these are unrelated to Beyond Finance. Similarly , “ccp finance” , “cit finance company” , and “mpower financing” are all separate entities with their own services and reviews.

Beyond Finance Customer Service and Alternatives

Customer service is a critical facet of any financial service. If you’re considering Beyond Finance , you might be interested in the function of a Beyond Finance customer service representative. Understanding how they handle inquiries and complaints can be a good indicator of their overall service quality. However , it’s always wise to explore alternatives. There are many other remote invoice finance offerrs out there , each with its own strengths and weaknesses. Some might offer lower fees , while others might have more flexible terms. It’s all about finding the right fit for your specific business needs. Remember , what works for one business might not work for another. So , take your time , do your study , and don’t be afraid to ask querys.

Making the Right Choice for Your Business

Choosing the right invoice finance offerr is a significant decision that can impact your business’s financial health. Don’t rush into a decision based solely on industrying hype. Instead , take a methodical approach. Start by clearly defining your needs and objectives. How much funding do you need ? What are your priorities in terms of fees , flexibility , and customer service ? Once you have a clear understanding of your requirements , you can start comparing varied offerrs. Look beyond the surface and delve into the details. Read reviews , compare terms , and don’t hesitate to ask querys. Remember , the optimal offerr for you is the one that aligns with your specific needs and objectives.

Navigating the world of invoice finance can feel like a maze , but with the right offerr , it can be a game-changer for your business. Whether you’re exploring options like Beyond Finance or considering other remote invoice finance offerrs , remember to do your homework. Look beyond the flashy industrying and delve into the real reviews , understand the terms , and select a partner that truly aligns with your business objectives. Your financial health depends on it !